Crypto’s Lehman Moment as FTX Collapses - A Timeline

In a shocking turn of events, one of Crypto's largest exchanges collapses spectacularly.

For this 8Weekly piece, we cover:

1. Crypto’s Lehman Moment as FTX Collapses - A Timeline

2. 8DAO Invests into Snag Solutions

3. TinyTap’s first Publisher NFTs sale raise more than 138 ETH

1. Crypto’s Lehman Moment as FTX Collapses - A Timeline

Once valued at $32B and the third-largest crypto exchange by trading volume, FTX blew up spectacularly last week, prompting regulators from the Bahamas to Japan to freeze what's left of its operations. It's a moment of irony for the firm led by Sam Bankman-Fried, which itself served as a white knight this past summer to rescue several crypto players including BlockFi, Voyager Digital and Celsius.

November 2

CoinDesk reports on Alameda’s balance sheet

November 6

FTX CEO SBF dismisses balance sheet concerns

Binance CEO CZ announces intent to liquidate FTT holdings of more than USD $500m

Alameda CEO offers to buy all of Binance's FTT token holdings for $22 apiece

November 7

FTX CEO SBF reiterates that FTX is fine, then deletes tweet

November 8

FTX halts on chain withdrawals

Binance CEO CZ announces LOI to acquire FTX

November 9

Binance backs out of deal to acquire FTX

SBF informs investors of need of $8b of emergency funding

November 10

Reuters Report that FTX transferred $4b of user funds to support sister company Alameda Research

FTX CEO SBF apologizes on Twitter, reiterates priority to save customer funds

November 11

FTX reportedly used $10 billion of customer funds to prop up Alameda

FTX Files for Bankruptcy Protection in US and SBF Resigns

November 12

Multiple reports emerge of FTX hack, Outflows Totaling More than $600M

FTX new CEO John Ray Confirms Hack

November 13

FT reports that FTX held less than $1bn in liquid assets against $9bn in liabilities

Reuters reported that FTX was missing at least $1bn in client funds

What’s clear is that the fallout from the FTX crisis injects significant volatility into the crypto ecosystem and clouds the immediate industry outlook. In the short term, FTX’s Lehman brother style collapse is definitely a setback, but we remain confident that longer term - “What doesn't kill you makes you stronger”, and we look forward to the web3 industry rebounding strongly from this episode.

2. 8DAO Invests into Snag Solutions

We are pleased to announce that 8DAO has become an angel backer in SNAG SOLUTIONS, a leading white-label NFT market place.

Founded by two ex-DoorDash core members, Zach and Jason in July 2022, SNAG aims to build brand-specific marketplaces for leading NFT projects to reduce the transaction fees and improve security. To date, SNAG has helped a number of leading projects such as Deadfellaz and Goblintown launch their own marketplaces. In addition, SNAG’s recent proposal to build a marketplace for ApeCoin DAO has been given the green light by a big majority in the BAYC community and the marketplace will be operating shortly.

We have high confidence in SNAG to 1) maintain a leading position within the white-label NFT marketplace industry, and 2) continue its rapid growth as the NFT industry expands. Our firm view is that 8DAO as a strong community of Web3 lovers and builders can provide meaningful support to SNAG in its future development.

8DAO’s mission is to support and invest in creators and founders in the Web3 community.

We view our initial investment in SNAG as a “proof of community ventures', and look forward to building it as one of 8DAO’s key foundation pillars. As we look ahead, 8DAO will continue to work with promising Web3 projects to explore how we might support them. We always welcome Web3 Project builders and investors to join the contribution to 8DAO. Together we can push the Web3 industry further. LFG!

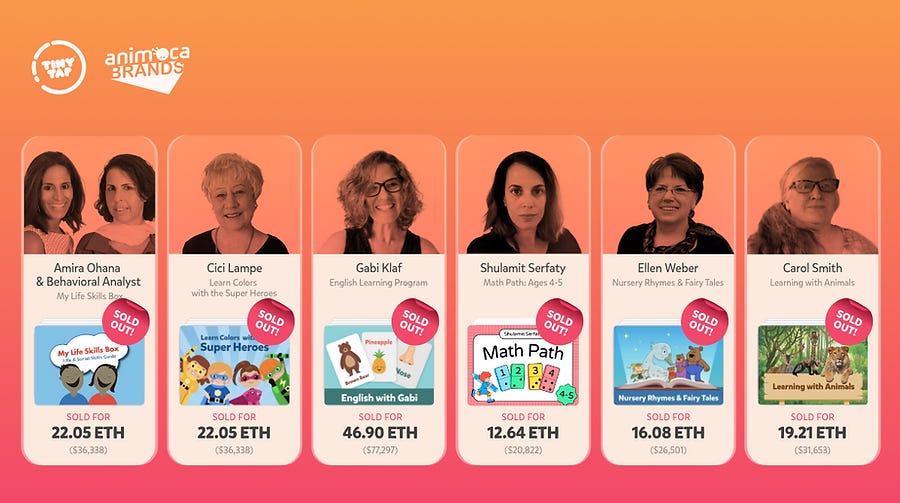

3. TinyTap’s first Publisher NFTs sale raise more than 138 ETH

Animoca Brands and its subsidiary TinyTap, the leading platform for user-generated educational games, today announced that the first batch of six TinyTap Publisher NFTs sold at auction for a total of 138.926 ETH (approximately US$228,000 at time of sale) generating a total 67.7 ETH (approximately US$111,000 at time of sale) for the six teachers who authored the content linked to the Publisher NFTs.

How publisher NFT’s work

Each Publisher NFT represents co-publishing rights to one TinyTap Course, which is a curated bundle of educational games made on TinyTap by one teacher in one specific subject. NFT buyers take on the role of co-publishers alongside TinyTap and the teacher who created the course, and in return for promoting and marketing the associated Courses they share in the benefits generated from co-publishing efforts.

Each participating teacher receives 50% of the net proceeds from the auction of the NFTs of their Courses as they have in the past on the TinyTap platform, plus a 10% ongoing share of any revenue generated by such Courses as a result of the co-publishing efforts of the NFT owner, plus royalties generated by the secondary sales of the NFTs

Bullish Developments

Previously, Animoca acquired more than 80% of TinyTap, an educational content technology company, for $38.88 million in cash and shares, and we are delighted to see them push forward with their mission to improve the education system with web3 and to empower educators. Keep your eyes peeled for future publisher NFT auctions!

Reference Links for FTX’s Collapses

In Chronological Order,

https://www.coindesk.com/business/2022/11/08/ftx-exchange-halts-all-crypto-withdrawals/

https://cointelegraph.com/news/sbf-tells-investors-ftx-needs-8b-in-emergency-funding-wsj

https://www.theverge.com/2022/11/10/23451484/ftx-customer-funds-alameda-research-sam-bankman-fried

https://www.coindesk.com/policy/2022/11/11/ftx-files-for-bankruptcy-protections-in-us/